Business Insurance in and around Lincoln

One of Lincoln’s top choices for small business insurance.

No funny business here

Help Prepare Your Business For The Unexpected.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, extra liability coverage and worker's compensation for your employees, you can feel secure knowing that your small business is properly protected.

One of Lincoln’s top choices for small business insurance.

No funny business here

Surprisingly Great Insurance

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a donut shop, an arts and crafts store or a clock shop. Agent Andy Van Horn is also a business owner and understands your needs. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Contact agent Andy Van Horn to explore your small business coverage options today.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

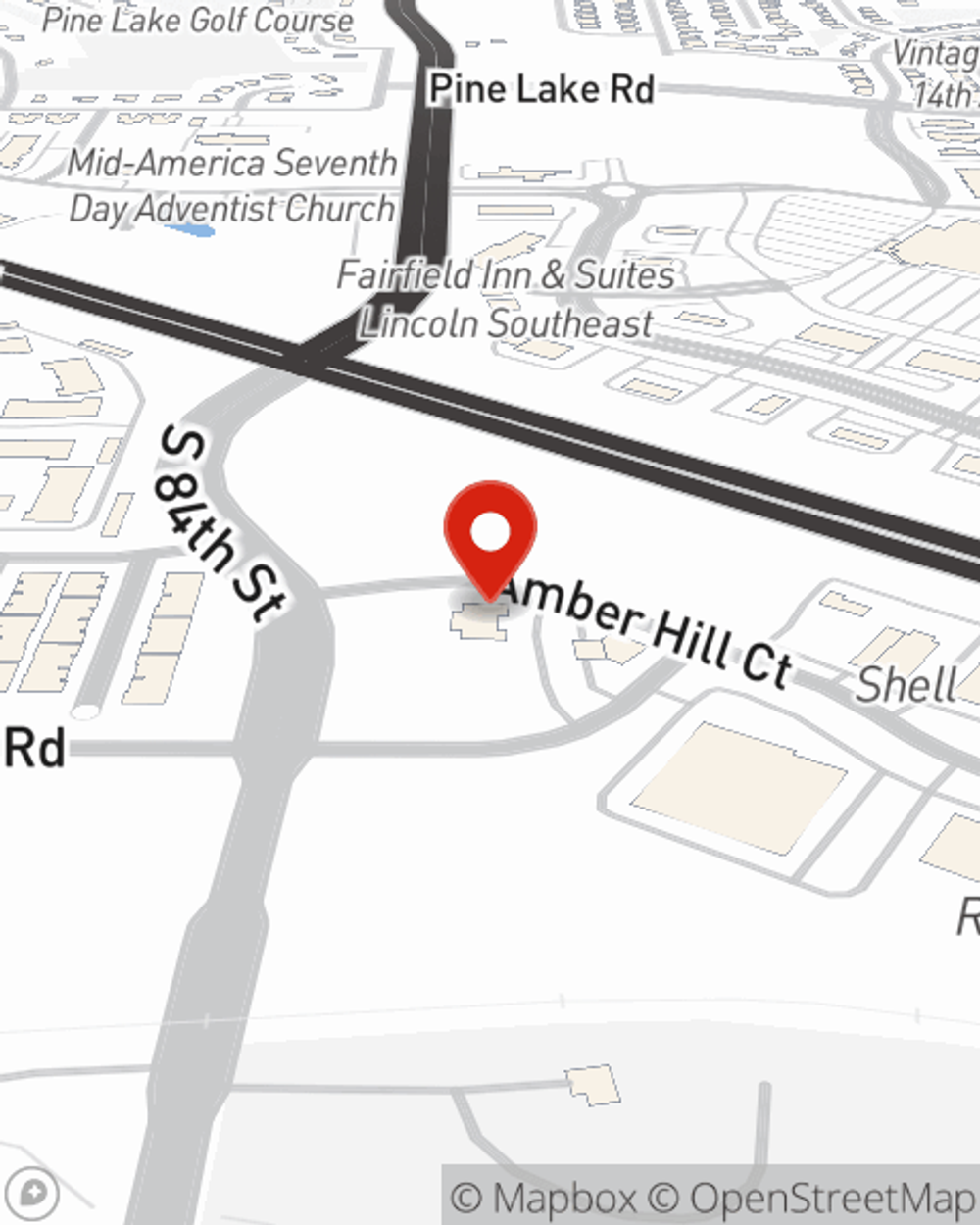

Andy Van Horn

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.